All Categories

Featured

Table of Contents

Merely pick any form of level-premium, irreversible life insurance plan from Bankers Life, and we'll convert your plan without needing evidence of insurability. Policies are convertible to age 70 or for 5 years, whichever comes later on - term life insurance with accidental death benefit. Bankers Life offers a conversion credit rating(term conversion allocation )to insurance policy holders approximately age 60 and with the 61st month that the ReliaTerm policy has actually been in pressure

They'll give you with simple, clear choices and help personalize a plan that satisfies your specific requirements. You can trust your insurance agent/producer to aid make complicated economic decisions concerning your future simpler (term life insurance scam). With a background going back to 1879, there are some things that never change. At Bankers Life, that means taking an individualized strategy to help secure the individuals and families we serve. Our objective is to give excellent solution to every insurance holder and make your life much easier when it comes to your claims.

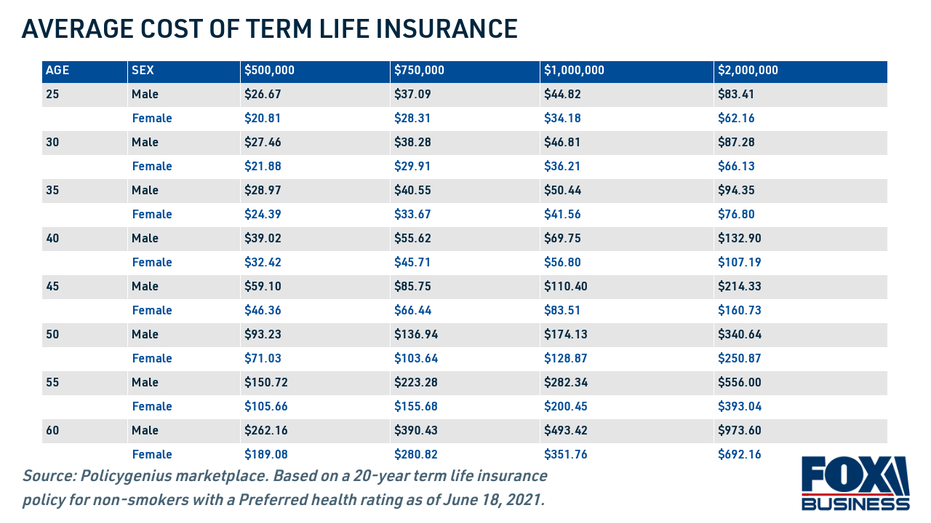

In 2022, Bankers Life paid life insurance policy declares to over 658,000 policyholders, completing$266 million. Bankers Life is recognized by the Better Service Bureau with an A+ ranking as of March 2023, along with getting an A( Exceptional)ranking by A.M. Generally, there are 2 types of life insurance policy plans-either term or permanent strategies or some combination of both. Life insurance companies use various forms of term plans and standard life plans along with "rate of interest sensitive"items which have ended up being much more prevalent considering that the 1980's. Term insurance provides protection for a specified period of time. This period could be as brief as one year or supply protection for a certain variety of years such as 5, 10, 20 years or to a defined age such as 80 or in many cases as much as the earliest age in the life insurance policy mortality. Presently term insurance policy prices are extremely affordable and among the most affordable traditionally experienced. It should be kept in mind that it is a widely held belief that term insurance is the least costly pure life insurance protection offered. One needs to assess the policy terms thoroughly to choose which term life options appropriate to satisfy your particular situations. With each brand-new term the premium is raised. The right to renew the plan without evidence of insurability is a vital advantage to you (decreasing term life insurance). Or else, the threat you take is that your wellness might weaken and you might be not able to get a plan at the same prices or even in any way, leaving you and your beneficiaries without protection. You must exercise this option during the conversion duration. The size of the conversion duration will certainly vary relying on the type of term plan purchased. If you transform within the recommended period, you are not called for to provide any info regarding your wellness. The premium rate you

pay on conversion is usually based on your"existing attained age ", which is your age on the conversion date. Under a level term policy the face amount of the plan stays the exact same for the whole period. With reducing term the face quantity lowers over the period. The costs remains the same every year. Frequently such plans are offered as home loan security with the quantity of.

insurance policy decreasing as the balance of the home loan lowers. Traditionally, insurance companies have actually not deserved to alter costs after the policy is offered. Since such plans may proceed for many years, insurance companies have to utilize conventional death, passion and expenditure rate quotes in the premium calculation. Adjustable premium insurance policy, nonetheless, permits insurance companies to offer insurance at lower" present "costs based upon much less traditional assumptions with the right to alter these premiums in the future. Under some policies, costs are needed to be spent for a set variety of years. Under other plans, premiums are paid throughout the policyholder's lifetime. The insurance provider invests the excess costs bucks This kind of policy, which is in some cases called cash money value life insurance coverage, creates a financial savings component. Money values are vital to a permanent life insurance plan. Occasionally, there is no connection in between the size of the cash worth and the premiums paid. It is the cash value of the plan that can be accessed while the insurance policy holder is alive. The Commissioners 1980 Requirement Ordinary Mortality(CSO )is the present table used in calculating minimum nonforfeiture worths and plan reserves for ordinary lifeinsurance policy policies. Many irreversible policies will certainly have arrangements, which define these tax obligation requirements. There are 2 standard classifications of long-term insurance, traditional and interest-sensitive, each with a variety of variants. Additionally, each classification is generally readily available in either fixed-dollar or variable form. Conventional whole life policies are based upon lasting quotes ofcost, rate of interest and mortality. If these quotes change in later years, the business will certainly readjust the premium accordingly however never over the optimum ensured premium specified in the policy. An economatic entire life plan offers a standard quantity of taking part entire life insurance policy with an added supplementary insurance coverage given with the use of returns. Since the costs are paid over a shorter span of time, the premium payments will be greater than under the entire life plan. Single costs whole life is limited payment life where one huge premium repayment is made. The policy is totally paid up and no further premiums are required. Since a significant settlement is entailed, it must be deemed an investment-oriented product. Passion in single premium life insurance policy is primarily because of the tax-deferred treatment of the accumulation of its money worths. Tax obligations will be sustained on the gain, nevertheless, when you give up the policy. You may obtain on the money value of the plan, yet bear in mind that you might sustain a substantial tax costs when you surrender, also if you have obtained out all the money value. The advantage is that improvements in passion prices will certainly be reflected faster in passion sensitive insurance coverage than in traditional; the disadvantage, of program, is that reduces in interest prices will additionally be felt faster in interest delicate whole life. There are four basic rate of interest sensitive entire life policies: The universal life plan is actually even more than rate of interest sensitive as it is designed to show the insurance provider's present death and cost as well as passion incomes as opposed to historical prices. The company credit histories your premiums to the money worth account. Occasionally the business subtracts from the cash value account its expenditures and the price of insurance defense, normally described as the mortality reduction charge. The balance of the cash value account collects at the rate of interest attributed. The company assures a minimum rate of interest and an optimum death cost. These warranties are typically really conservative. Existing assumptions are vital to rate of interest delicate products such as Universal Life. When rates of interest are high, advantage forecasts(such as cash value)are likewise high. When rates of interest are reduced, these estimates are not as appealing. Universal life is additionally the most flexible of all the various sort of plans. The policy normally offers you an option to select one or 2 kinds of death benefits. Under one option your beneficiaries received just the face amount of the policy, under the other they receive both the face amount and the money value account. If you desire the optimum quantity of fatality advantage currently, the second alternative needs to be chosen. It is important that these assumptions be sensible because if they are not, you may need to pay more to keep the plan from decreasing or lapsing. On the other hand, if your experience is better then the assumptions, than you may be able in the future to skip a premium, to pay less, or to have actually the plan compensated at a very early day. On the other hand, if you pay even more, and your assumptions are realistic, it is feasible to compensate the plan at an early date (term rider life insurance definition). If you surrender an universal life policy you may obtain much less than the cash money value account as a result of surrender fees which can be of two kinds.

You might be asked to make additional costs payments where insurance coverage might terminate due to the fact that the passion price dropped. The assured price provided for in the policy is a lot reduced (e.g., 4%).

Who Sells Decreasing Term Life Insurance

In either situation you should get a certificate of insurance defining the provisions of the team policy and any insurance charge. Generally the optimum quantity of coverage is $220,000 for a home loan and $55,000 for all other financial obligations. Credit history life insurance policy need not be bought from the organization giving the lending

If life insurance policy is required by a creditor as a condition for making a lending, you might have the ability to appoint an existing life insurance coverage policy, if you have one. You may desire to acquire group credit scores life insurance in spite of its higher price since of its ease and its schedule, typically without comprehensive proof of insurability. can i get term life insurance if i have cancer.

However, home collections are not made and premiums are mailed by you to the agent or to the business. There are certain aspects that have a tendency to increase the costs of debit insurance policy greater than routine life insurance plans: Specific expenditures coincide regardless of what the size of the plan, so that smaller sized policies released as debit insurance will certainly have higher premiums per $1,000 of insurance policy than larger size regular insurance coverage

Considering that early lapses are pricey to a business, the prices need to be handed down to all debit policyholders. Because debit insurance coverage is made to include home collections, greater compensations and fees are paid on debit insurance than on normal insurance policy. In most cases these greater costs are passed on to the insurance holder.

Where a firm has various premiums for debit and routine insurance coverage it might be feasible for you to buy a bigger amount of routine insurance policy than debit at no additional price - decreasing term mortgage life insurance. If you are thinking of debit insurance coverage, you ought to definitely explore regular life insurance coverage as a cost-saving choice.

A Long Term Care Rider In A Life Insurance Policy Pays A Daily Benefit

This strategy is developed for those who can not originally manage the normal entire life premium yet who want the greater premium insurance coverage and feel they will ultimately be able to pay the higher premium (extending term life insurance). The household policy is a mix strategy that gives insurance coverage protection under one contract to all members of your instant family members partner, spouse and youngsters

Joint Life and Survivor Insurance coverage provides protection for two or more persons with the death advantage payable at the fatality of the last of the insureds. Premiums are considerably lower under joint life and survivor insurance than for policies that guarantee just one individual, because the likelihood of needing to pay a death claim is lower.

Premiums are dramatically greater than for policies that guarantee one person, because the chance of having to pay a fatality insurance claim is greater (return of premium vs term life insurance). Endowment insurance policy provides for the repayment of the face total up to your recipient if fatality occurs within a particular time period such as twenty years, or, if at the end of the details duration you are still alive, for the settlement of the face total up to you

Table of Contents

Latest Posts

Term Life Insurance Scam

Funeral Insurance Coverage

Funeral Cover Insurance

More

Latest Posts

Term Life Insurance Scam

Funeral Insurance Coverage

Funeral Cover Insurance